Optimizing Risk Management with Numerical Methods

19. August 2024

UnRısk News: Latest Highlights and Innovations

21. August 2024

Challenges in Dupire Model Calibration

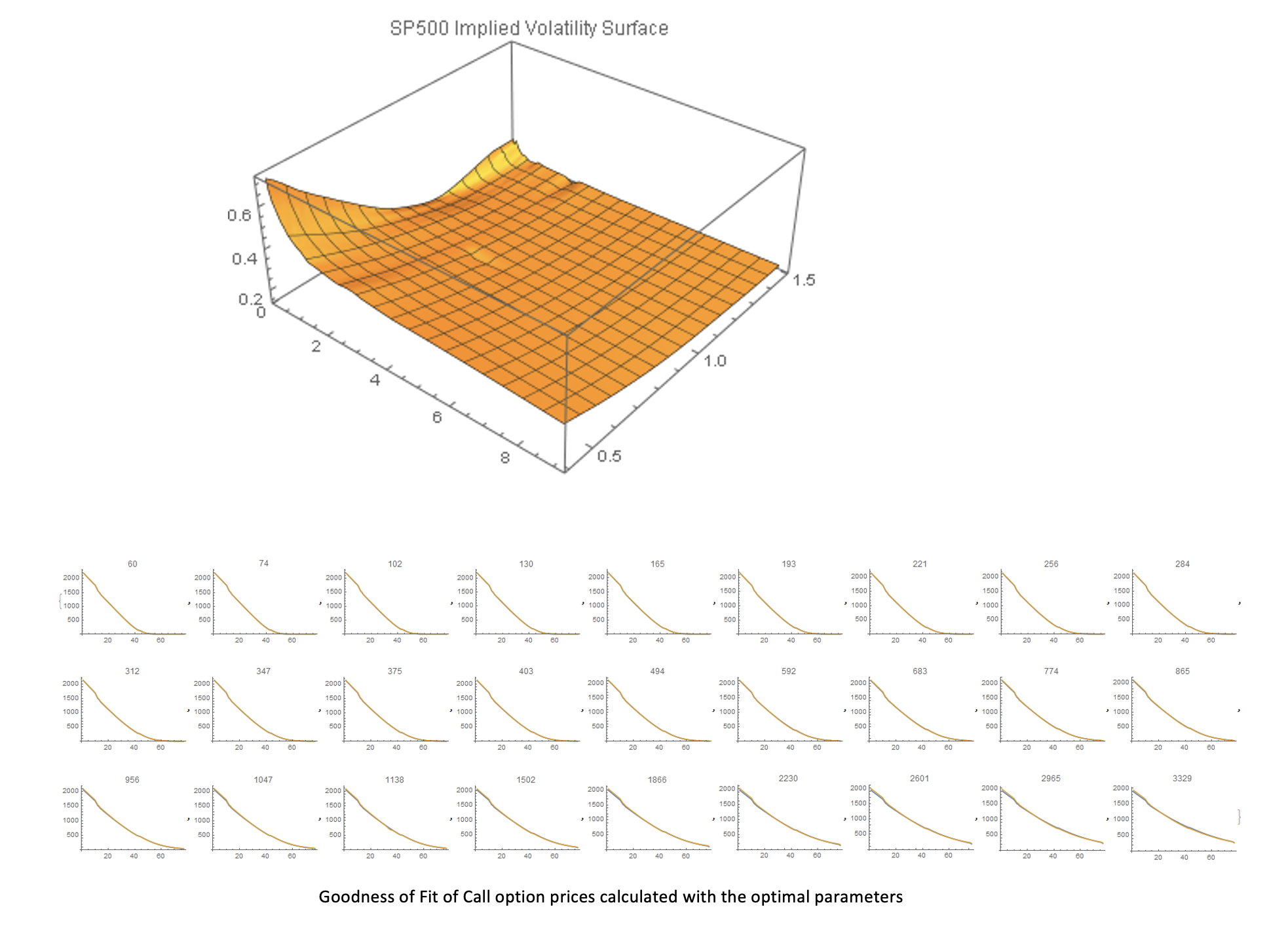

On the basis of market prices of a series of liquid vanilla options, we calibrate a Local Volatility option pricing model, which can be used to compute the prices of more complex exotic options.

Since in reality, the volatility varies for different strikes, the Black-Scholes model, where the volatility function is assumed to be constant for all maturities and strikes has been replaced by more sophisticated models which include local and stochastic volatility.

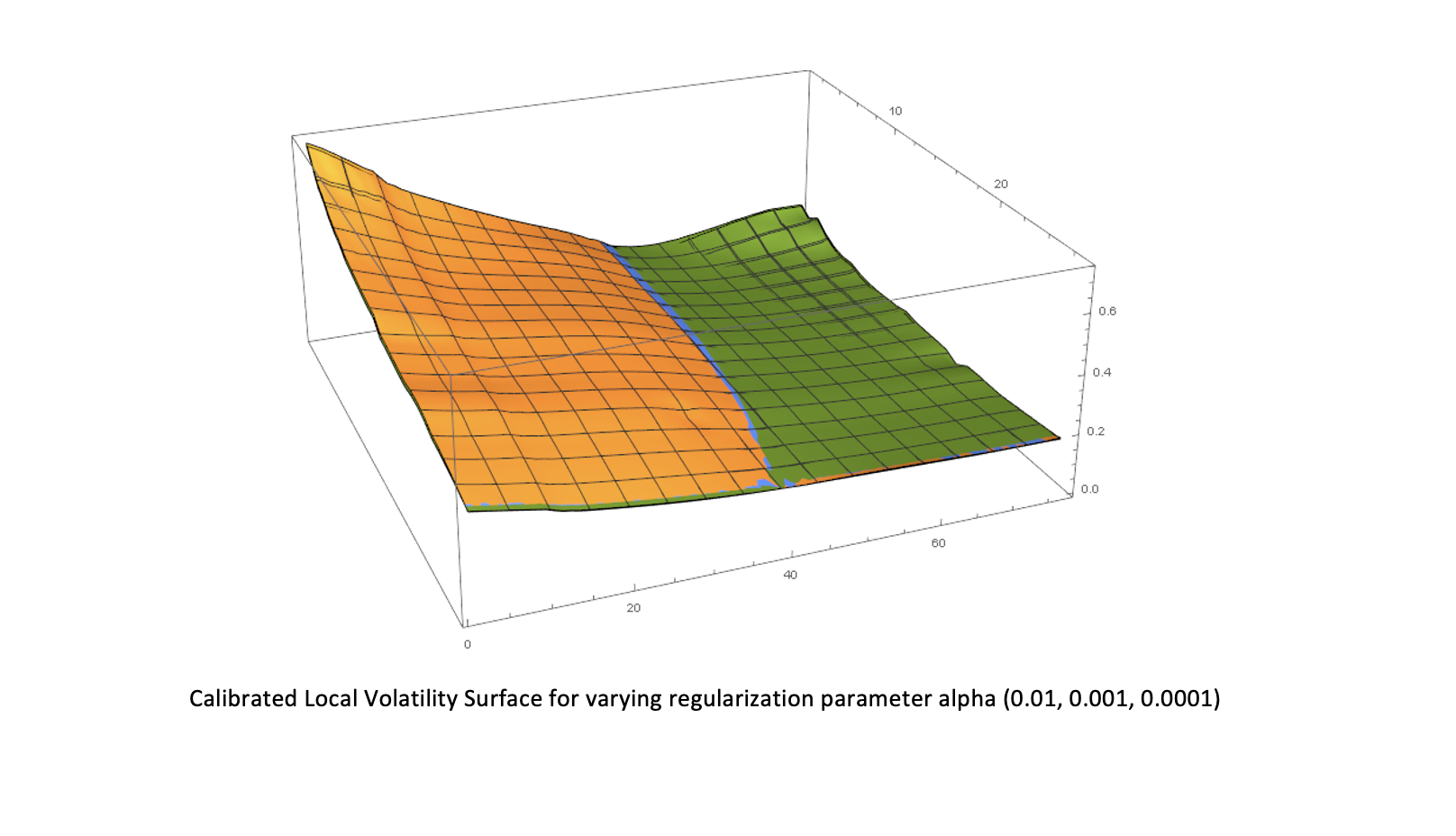

Determining the parameters of such a model in a way that the model prices of a set of options match the set observed market prices is the so-called calibration process. Mathematically this parameter identification is an ill-posed inverse problem and there may be several models with different parameters, which reproduce the quoted market prices in the same way. So the solution of the inverse problem needs not be unique, which leads to model uncertainty. Furthermore, the solution does not depend continuously on the input data. To overcome the ill-unconditionedness of the calibration problem, fast and stable algorithms have to be used. To guarantee stable parameters, the usage of regularization methods is essential.

We formulate the calibration problem as an optimization problem, where the goal is to fit the market prices as good as possible. The measure of the discrepancy between model prices and observed market prices is the sum of squared differences between them:

where S is the spot price of the underlying asset; K is the strike price of the option; T is the maturity of the option, w is the weight of the given option in cost function and t is the time at which the option is priced.

To solve the optimization problem classical gradient based methods can be used. To get the prices of the options for given parameters in the model, we have to solve a partial differential equation or use a Monte Carlo simulation. However, the objective function is not necessarily convex and so we cannot be sure that gradient based methods will not end up in a local minimum instead of the global one.

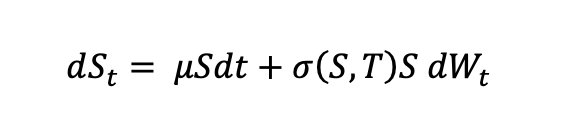

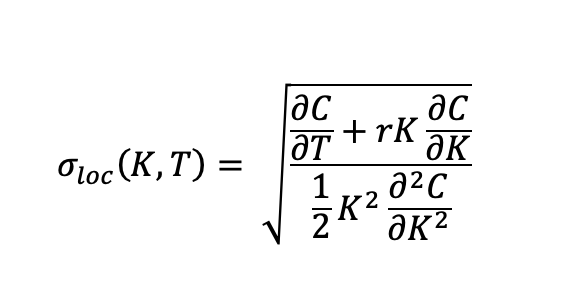

Dupire (1994) introduces the local volatility model, where the underlying price process is assumed to follow the stochastic process.

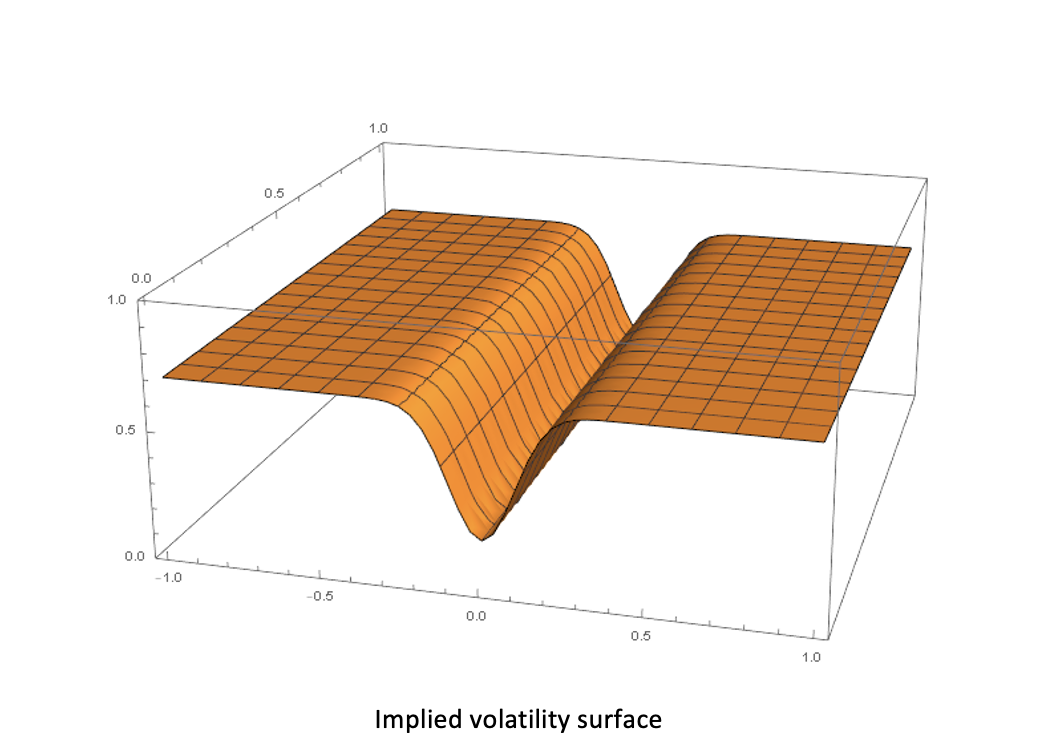

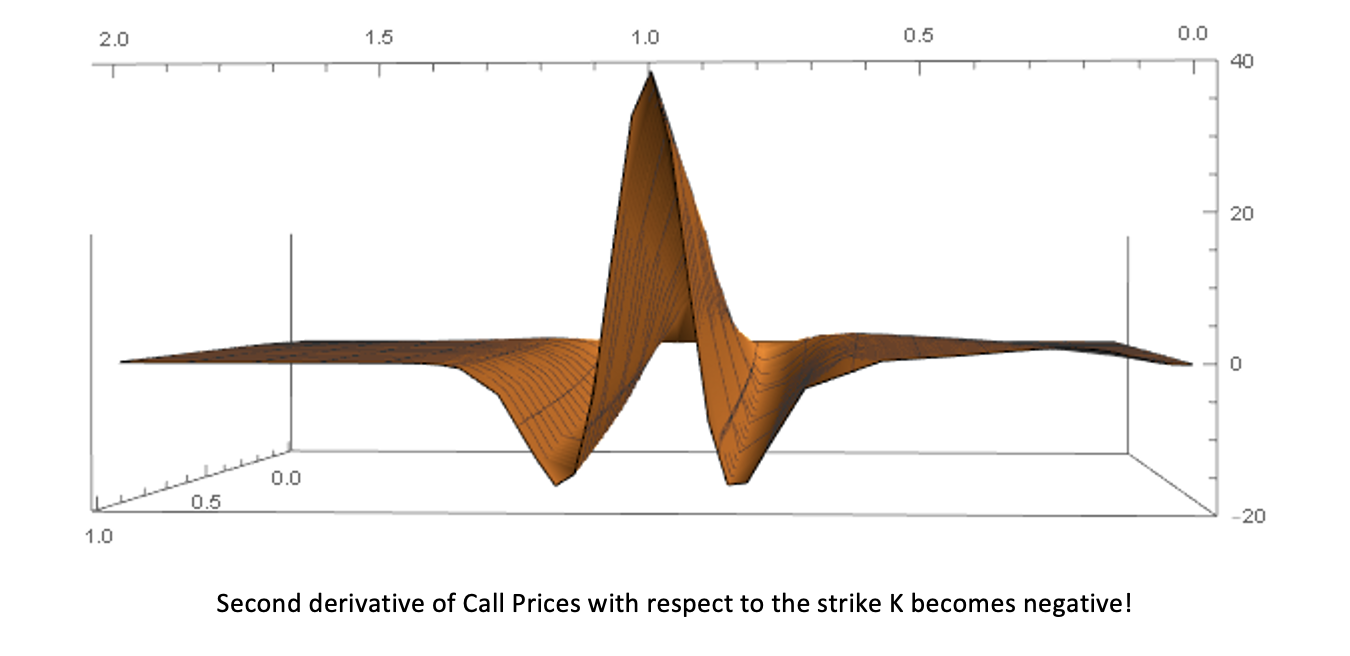

The market option prices, corresponding to the implied volatility surface above calculated by the Black Scholes formula have the following shape and the second derivative with respect to the strike K which is part of the local vola formula becomes negative which leads to the fact that the local volatility cannot be calculated for this setting.